pravopobeda.ru Recently Added

Recently Added

How To Save To Move Out On Your Own

Understanding your financial situation is the first crucial step in preparing for a move. By examining your income, expenses, and potential savings areas, you'. The student will be able to calculate how long it will take them to save up enough money to move out. REVIEW (3 min.) 1. How many of you could afford to make. Experts advise having three to six months' worth of basic living expenses stashed away (a high-yield savings account can work well). Figure out what that amount. What do I need to do before I move out? · Find a new place · Notify your landlord · Create a budget and packing list · Get rid of your unwanted items · Clean and. The thought of being on your own might be exciting, but it's a decision that should be weighed and planned before executing. It's crucial to understand your. And $10, is a good amount of money to have saved up before moving out of state. How to Save Money for Moving Out. Wondering how to save enough money to move. Determine how much of your savings you're willing to allocate towards moving out expenses, such as rental deposits, furniture purchases, and other upfront costs. Did You Know? One of the biggest mistakes people make when moving out on their own is not having an emergency fund. Set aside some money to handle unexpected. Determine how much of your savings you're willing to allocate towards moving out expenses, such as rental deposits, furniture purchases, and other upfront costs. Understanding your financial situation is the first crucial step in preparing for a move. By examining your income, expenses, and potential savings areas, you'. The student will be able to calculate how long it will take them to save up enough money to move out. REVIEW (3 min.) 1. How many of you could afford to make. Experts advise having three to six months' worth of basic living expenses stashed away (a high-yield savings account can work well). Figure out what that amount. What do I need to do before I move out? · Find a new place · Notify your landlord · Create a budget and packing list · Get rid of your unwanted items · Clean and. The thought of being on your own might be exciting, but it's a decision that should be weighed and planned before executing. It's crucial to understand your. And $10, is a good amount of money to have saved up before moving out of state. How to Save Money for Moving Out. Wondering how to save enough money to move. Determine how much of your savings you're willing to allocate towards moving out expenses, such as rental deposits, furniture purchases, and other upfront costs. Did You Know? One of the biggest mistakes people make when moving out on their own is not having an emergency fund. Set aside some money to handle unexpected. Determine how much of your savings you're willing to allocate towards moving out expenses, such as rental deposits, furniture purchases, and other upfront costs.

Creating a budget is the first item on your moving-out checklist. Establish your budget. When moving for the first time, consider making two budgets: one for. Costs of moving out. Moving out means more than just paying rent and other bills. · Work out what you can afford. Before you move out, create a budget. · Sharing. Tips for building finances and getting a place of your own. It's normal to need a soft place to land before you launch, and Mom and Dad's basement might seem. Staying on your own won't always be rosy, especially when you have to pay utility bills. One of the ways you can manage your expenses is by having insurance. Create a personal budget. You're ready to be (and be treated like) an adult, and want your own place like one. Prove it by getting serious about your finances. How to Set Yourself Up to Move Out on Your Own · Tip #1- Earn more money · Tip #2- Get out of Debt · Tip #3- Improve your credit score · Tip #4- Create a Budget. 1. Save up before you move · Open a savings account and set yourself a savings goal e.g. rental bond and 2 months' rent. · Calculate how much you can afford to. 1) Set a Budget · 2) Consider the Start-Up Costs of Moving Out · 3) Build Credit and Plan To Handle Any Debt Payments You May Have · 4) Practice Making Monthly. In the months leading to the move, a great way to save money for it is to get a part-time job or a side gig. You can find side hustles on sites for finding jobs. 10 tips for moving out on your own · 1. Set a date and stick to it · 2. Nail down your finances · 3. Lock down a steady income · 4. Practice budgeting while you. Cut your outgoings You can save more towards moving out by spending less on: Before you take any decisions, especially if they'll mean being tied into a. You should pay off as much debt as possible before considering moving out on your own. a little steep, but there are ways to save money when moving out. You'll know you're ready to move if you have a savings fund with enough money to live off of for at least 3 months, plus a steady income (or a job lined up) to. Living on your own requires a reliable support network outside of your family. Finding an ideal community is a crucial thing to do before you move out. You. Instead of getting overwhelmed, why not use the opportunity to create a budget for yourself? Getting your expenses down on paper can be a real eye-opener and. How to Set Yourself Up to Move Out on Your Own · Tip #1- Earn more money · Tip #2- Get out of Debt · Tip #3- Improve your credit score · Tip #4- Create a Budget. Even if your college student is good at managing money, moving out on their own can be disorienting. Plan a budget before they go, and check in with them. Just because you have enough cash in your bank account to pay rent each month doesn't mean you have enough to move out. In order to be financially safe, experts. How to Save Money When Moving Out of State · 1. Start early. If you know exactly when you're moving, book movers or reserve a moving truck or pod as early as.

How Much Can You Loan From A Bank

Simple, digital application for loan amounts up to $25,; Terms available: 12 - 60 months; Annual Percentage Rates range from % to %; No closing. This short-term low-cost loan for checking account customers can help you with unexpected expenses. Apply to borrow up to $ when you need it, for only a low. How much can I borrow? · You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Estimate your FICO ® Score range. You can fund your loan today if today is a banking business day, your How much do you want to borrow? $3, ‐ $4,; $5, ‐ $9,; $10, ‐ $24, Banks and financial institutions (FI) may let you borrow up to six times your monthly income for personal loans. Let's say your monthly income is S$5, and. Through Bank of America, you can generally borrow up to 85% of the value of your home minus the amount you still owe. On screen copy: Bank of America® logo. In determining an applicant's maximum loan amount, lenders consider debt-to-income ratio, credit score, credit history, and financial profile. Government-. The Preferred Rewards program is our way of rewarding you for what you already do. Preferred Rewards members may qualify for an origination fee or interest rate. Personal loans provide you fast, flexible access to funds that can be used for many major life events, expenses or consolidating debt, all with one fixed. Simple, digital application for loan amounts up to $25,; Terms available: 12 - 60 months; Annual Percentage Rates range from % to %; No closing. This short-term low-cost loan for checking account customers can help you with unexpected expenses. Apply to borrow up to $ when you need it, for only a low. How much can I borrow? · You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Estimate your FICO ® Score range. You can fund your loan today if today is a banking business day, your How much do you want to borrow? $3, ‐ $4,; $5, ‐ $9,; $10, ‐ $24, Banks and financial institutions (FI) may let you borrow up to six times your monthly income for personal loans. Let's say your monthly income is S$5, and. Through Bank of America, you can generally borrow up to 85% of the value of your home minus the amount you still owe. On screen copy: Bank of America® logo. In determining an applicant's maximum loan amount, lenders consider debt-to-income ratio, credit score, credit history, and financial profile. Government-. The Preferred Rewards program is our way of rewarding you for what you already do. Preferred Rewards members may qualify for an origination fee or interest rate. Personal loans provide you fast, flexible access to funds that can be used for many major life events, expenses or consolidating debt, all with one fixed.

If you, like Sue and Jack, have heard of personal loans but find yourself searching "how to get a personal loan from a bank," you're not alone. What is an. With minimum loan amounts starting at $7, you can choose the term you're most comfortable with. Loans are available with or without collateral. Whatever loan. you'll need to make sure it works within your budget. Our Financial Calculators can help you find out how much you could be paying on your mortgage within. An error occurred. Based on the income and financial commitments you entered, you do not meet the National Bank's eligibility ratios for mortgage financing. Before applying for a loan, you should consider the 5 Cs of Credit. Learn what lenders look for when you want to get approved for a loan. Personal loans are loans with fixed amounts, interest rates, and monthly payback amounts over defined periods of time. Typical personal loans range from $5, How much do you need to borrow? Loan Amount. Next. Skip. Results. Savings will automatically get withdrawn as long as there's enough in your bank account. How much can I apply for and what loan terms are available?Expand. We offer personal loans ranging from $3, to $, 12 – 84 months for personal loans. Many credit card companies use compound interest when calculating your monthly payment, which can make it costly to carry a balance. What is APR? Most lenders. You can typically borrow up to 85% of the value of your home minus the amount you owe. Also, a lender generally looks at your credit score and history. Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. These monthly expenses include property. Maximum loan amount for existing customers is $50k. Make an appointment Loan details. use a regions account balance as collateral. Deposit Secured. How much you can borrow will depend on your financial position and how much flexibility you have in your budget. You'll need to weigh your income versus your. loan fees and explains how much they could cost you Sometimes, there is a grace period of one to five days after the due date, to allow for bank processing. An error occurred. Based on the income and financial commitments you entered, you do not meet the National Bank's eligibility ratios for mortgage financing. How Do Bank Loans Work? Bank loans offer a lump sum of funding up front that you pay back over time. You can usually borrow anywhere from $1, to $50, or. But like all debt, personal loans are not to be taken lightly. Once you've figured out how much you need to borrow and how much you can afford to pay back each. A personal loan is a lump sum of money you borrow from a bank or other lender and your monthly payment to estimate how much you can reasonably afford. Should you fail to charge an adequate interest rate, the IRS could treat the interest you failed to collect as a gift. What's more, if the loan exceeds $10, Taking a (k) loan means borrowing money from your retirement savings account. You can usually borrow up to $50,, which must be repaid.

How Do You Port A Number

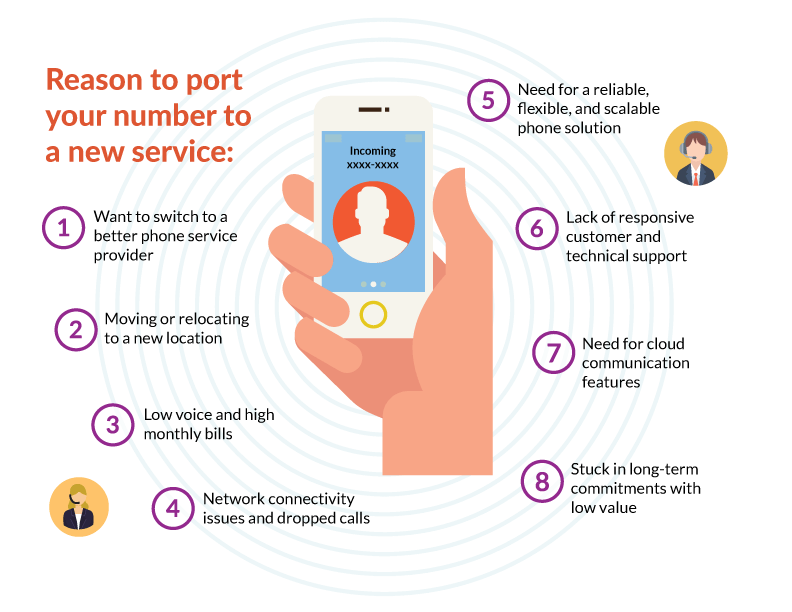

Porting your existing phone number to Grasshopper is easy and free of charge. Transfer your number and manage your business on the go with a virtual phone. For the most accurate information, and the shortest possible port time, we recommend contacting the current provider for the telephone number to obtain the. Number porting is the process of taking an existing phone number and transferring it to another provider. Discover how you can effortlessly move your existing number to MightyCall with our step-by-step video guide. Watch to get started! 1. Determine whether your number is eligible for porting. 2. Leave your current service enabled. 3. Sign up for a new service and phone number. 4. Provide. A consumer wishing to port a number should contact the prospective new carrier, who will start the process of porting by contacting the consumer's current. Contact your new provider to begin the process of transferring a pravopobeda.ru number. Contact the new provider to start the port-out process. You will need to have a Sideline account to port your number in. Please create one, or log into an existing account. When you activate a new line with Verizon you'll have the option to transfer your current mobile or landline number from another carrier. You can also visit our. Porting your existing phone number to Grasshopper is easy and free of charge. Transfer your number and manage your business on the go with a virtual phone. For the most accurate information, and the shortest possible port time, we recommend contacting the current provider for the telephone number to obtain the. Number porting is the process of taking an existing phone number and transferring it to another provider. Discover how you can effortlessly move your existing number to MightyCall with our step-by-step video guide. Watch to get started! 1. Determine whether your number is eligible for porting. 2. Leave your current service enabled. 3. Sign up for a new service and phone number. 4. Provide. A consumer wishing to port a number should contact the prospective new carrier, who will start the process of porting by contacting the consumer's current. Contact your new provider to begin the process of transferring a pravopobeda.ru number. Contact the new provider to start the port-out process. You will need to have a Sideline account to port your number in. Please create one, or log into an existing account. When you activate a new line with Verizon you'll have the option to transfer your current mobile or landline number from another carrier. You can also visit our.

With number porting, you can transfer your existing phone number to your new phone provider, so customers can reach you the same way they always have. Learn how to switch carriers and bring your phone number to AT&T. Plus check if your number is eligible to port or transfer over to our network. Account number: You will need to call customer service at to ask them to release your mobile number for porting and tell you your account number. Here's the information you'll need to transfer your number: Contact your current service provider and do the following: Request a Porting Pin / Password. To transfer your number, you'll need to keep your existing service active and request that your current number be transferred over to us. It's only when you get the SIM card, activate it, and complete the port that your Verizon number will move to AT&T. Want to bring your number to Metro? Learn how to complete the port-in process here. Number porting lets customers retain the same phone number while switching service providers, avoiding service interruptions and maintaining their existing. Porting a phone number to Local Inbound · Select the requested due date. · If necessary, clear the Autoport checkbox and select a time to port the phone number. Number porting is the process of transferring a phone number from one service provider to another, such as a phone carrier or VoIP system. Number porting is the process of taking an existing phone number and transferring it to another provider. In this blog, we'll walk you through the steps for how to port a number to a new provider, so you can confidently switch carriers and keep your same number. In this article, we will cover all possible scenarios and try to answer all questions that you might have on porting numbers to and from Google Voice. It will first check the porting number eligibility and then it will prompt you to setup an iPlum account using your physical mobile phone number. The number(s) you are porting · Your account number (this number often differs from your wireless phone number) · Your account's PIN/passcode (if applicable) · The. How it Works · You select your custom phone number · We secure it with our vendor · We transfer it to our carrier · We activate it and give you porting. We'll miss you! You'll need to contact the new carrier that you are moving to for specific instructions. If they need your US Mobile A ccount number and PIN. How do I port my number? Log in to your dashboard and click on “services”. You will be asked to enter the number printed on your SIM card and to select the. Discover how you can effortlessly move your existing number to MightyCall with our step-by-step video guide. Watch to get started! A consumer wishing to port a number should contact the prospective new carrier, who will start the process of porting by contacting the consumer's current.

How Much Does It Cost To Change All 4 Tires

When I ordered my car I chose to have a spare tire because I did not plan to get runflats when I replaced my tires (they're expensive, often have no warranty. Shop Costco for low prices on car, SUV and truck tires. Tires purchased online include Free Shipping to your Costco Tire Center for installation on your. If you're looking to replace all four tires on your car, you can expect to spend anywhere from $ to $1, Of course, tire prices vary depending on the. Find the perfect tires for your vehicle at Pep Boys. Explore our wide selection of brands and tire types for all driving conditions and seasons. Just as the cost of a pair of shoes can vary, so too can the cost of on-rim tire changes and replacements. The average cost in Canada can range from $70 to $ Should I replace all 4 tires? Can I get away with replacing 2 tires? Does it really matter where my new tires are mounted? These are all important. According to sources around the internet, the average cost of a full set of tires is around $ However, tire prices vary widely by size and intended use. A. It's expensive, but if your tire tread is worn you have to consider buying 4 new tires. Everyone who owns a car puts themselves at risk for unwanted costs. It. cost of a set of tires. You might even consider replacing just two instead of all four tires to save money. However, doing so can impact vehicle safety. When I ordered my car I chose to have a spare tire because I did not plan to get runflats when I replaced my tires (they're expensive, often have no warranty. Shop Costco for low prices on car, SUV and truck tires. Tires purchased online include Free Shipping to your Costco Tire Center for installation on your. If you're looking to replace all four tires on your car, you can expect to spend anywhere from $ to $1, Of course, tire prices vary depending on the. Find the perfect tires for your vehicle at Pep Boys. Explore our wide selection of brands and tire types for all driving conditions and seasons. Just as the cost of a pair of shoes can vary, so too can the cost of on-rim tire changes and replacements. The average cost in Canada can range from $70 to $ Should I replace all 4 tires? Can I get away with replacing 2 tires? Does it really matter where my new tires are mounted? These are all important. According to sources around the internet, the average cost of a full set of tires is around $ However, tire prices vary widely by size and intended use. A. It's expensive, but if your tire tread is worn you have to consider buying 4 new tires. Everyone who owns a car puts themselves at risk for unwanted costs. It. cost of a set of tires. You might even consider replacing just two instead of all four tires to save money. However, doing so can impact vehicle safety.

$*. Cost includes mounting and balancing, and TPMS kit. Note: The TPMS kit price may not apply for all vehicles and may be excluded from your purchase. It is recommended to replace your tires in sets of four for all vehicles but particularly important for all-wheel drive vehicles. All four tires should be. (Most tire shops charge and average of 10% of the tire cost for the Road Yelp Review: I needed to change all 4 of my tires. I usually go to Costco. How often should I check my tire pressure? ANSWER: Checking your tire Offer is subject to change at any time and/or is subject to termination without notice. The cost of all-season tires falls in the range of $ and $ How much does a tire replacement cost? In addition to the cost of the tires, there are. Replacing the other three partially worn tires along with the damaged tire significantly increases the cost. And while this will often result in just a. In the middle are SUVs, trucks or sporty vehicles with tire prices landing somewhere between $$ per tire. If you're driving a luxury vehicle that cost. About how much should I expect to pay for new tires? Answer. New tire prices can How much does it cost to get an oil change? How much will a brake. If you're looking for tire installation near you that combines safety and value, we've got you covered. Learn about tire installation costs and all that we do. Inexpensive tires will generally be in the range of $50 - $ each. · Moderately priced tires will usually be in the range of $ - $ each. · High-end tires. Can I replace just one tire on my car? For all-wheel-drive (AWD) cars, it is recommended that all four tires be replaced at the same time. This is because in. The four tires of a car are always alike. Their size, tread pattern, and model should be the same for the best results. As for all-wheel drive vehicles. tires and can replace it themselves. They would guide you and offer the best solution at no cost at all. To keep your car tires healthy, ensure you check. Tires need to be changed in the winter and the spring so your total cost should not be more than $ to $ for the whole year. Always change all four tires. The four tires of a car are always alike. Their size, tread pattern, and model should be the same for the best results. As for all-wheel drive vehicles. Can I change my tire rims? Do I need to change all 4 of my rims at once? Can I change the size of my tire rims? How long does it. How our common maintenance costs compare to our competition in San Jose, CA. Synthetic Oil Change, Tire Rotation, Engine. For replacing all four, Costco or Discount Tires have much better deals but Of you only replace the rears, which is the minimum to keep matched set. (based on taking care of your typical 60K mile tires) · Mounting and Balancing – up to $ pending wheel diameter · Lifetime Rotation – $ · Lifetime.

What Is Annuitization

:max_bytes(150000):strip_icc()/VariableAnnuitization-asp-v1-5dedf8fee4694d8dacd2ac7eb7b0757e.jpg)

Annuitization is the one-time event of converting the accumulation phase of a contract into an annuity of income payments either for a set term or for life. ANNUITIZE definition: If you annuitize a lump sum payment, you convert it into a regular income such as a | Meaning, pronunciation, translations and. Annuitization is the process of converting the cash you have placed in an annuity into regular payments that can last the rest of your life. Annuitization refers to the process of converting a lump sum of money, typically from a retirement savings account, into a series of regular payments over a. What Is an Annuity? An annuity is a contract under which an insurance company pays you income at regular intervals, during the payout phase. What is an Annuity? An annuity is a contract in which an insurance company makes a series of income payments at regular intervals in return for a premium or. Annuitize: A method of receiving annuity benefits through a series of income payments for life or some other defined time period. Annuity: A written contract. The meaning of ANNUITIZE is to convert an amount of money (such as an accumulation of retirement savings) to an annuity. How to use annuitize in a sentence. Annuitization is the process by which the holder/owner of an annuity receives the payouts from it. The income from an annuity can either be paid out all at. Annuitization is the one-time event of converting the accumulation phase of a contract into an annuity of income payments either for a set term or for life. ANNUITIZE definition: If you annuitize a lump sum payment, you convert it into a regular income such as a | Meaning, pronunciation, translations and. Annuitization is the process of converting the cash you have placed in an annuity into regular payments that can last the rest of your life. Annuitization refers to the process of converting a lump sum of money, typically from a retirement savings account, into a series of regular payments over a. What Is an Annuity? An annuity is a contract under which an insurance company pays you income at regular intervals, during the payout phase. What is an Annuity? An annuity is a contract in which an insurance company makes a series of income payments at regular intervals in return for a premium or. Annuitize: A method of receiving annuity benefits through a series of income payments for life or some other defined time period. Annuity: A written contract. The meaning of ANNUITIZE is to convert an amount of money (such as an accumulation of retirement savings) to an annuity. How to use annuitize in a sentence. Annuitization is the process by which the holder/owner of an annuity receives the payouts from it. The income from an annuity can either be paid out all at.

An annuity can provide you income for as long as you live through annuitization* at no extra cost, or via an optional benefit rider available for an additional. Annuitization is the even distribution of both principal and interest or growth of the annuity over a specified period of time. That period of time is selected. The person entitled to receive annuity payments or who now receives them. ANNUITIZE. A method of receiving annuity benefits through a series of income payments. If you've ever owned an annuity – or viewed a contract – you'll notice it has a Maturity Date. Sometimes called an Annuity Date, this date is far off into the. An annuity is a financial contract between an annuity purchaser and an insurance company. The purchaser pays either a lump sum or regular payments over a period. An annuity is an insurance contract sold by insurance companies. The insurer provides for either a single income payment or a series of income payments at. Annuitization results from your election to receive regular income payments from your contract. Once you choose to annuitize your contract, that decision cannot. So, annuitization simply means that you convert your annuity product from a deferred annuity to an immediate annuity. Or that you purchase an immediate annuity. During the annuitization phase, the policyholder can swap the accumulated value of their annuity in exchange for a steady stream of regular income payments. The. Simply put, an annuity plan that gives you a guaranteed1 amount throughout the tenure of the policy is a fixed annuity plan. This guaranteed amount is pre-. An annuity is a contract that requires regular payments for more than one full year to the person entitled to receive the payments (annuitant). You can buy. What is an annuity? At its most basic level, an annuity is a contract between you and an insurance company that shifts a portion of risk away from you and. An annuityAnnuityAn insurance product that earns interest and generates periodic payments over a specified period of time, typically with the purpose of. 6 Types of Annuity Payout Options Explained · 2. Life Only. Under the life-only option, sometimes called a pure life income, payments stop when the annuitant. Annuitant —The person who gets income payments from an annuity (such as you or your beneficiary/ survivor). Annuitization period —The period when you get income. If an annuity owner is a Florida resident and the insurance company licensed to sell annuities in Florida becomes insolvent, a fixed deferred annuity will be. An annuity is a financial product sold by an insurance company. It involves a contract between you and the insurance company that. Issue: An annuity is an insurance contract sold by insurance companies. The insurer provides for either a single income payment or a series of income payments. Converting an annuity's accumulated value into a periodic income stream is called annuitization. This involves transitioning the annuity from the accumulation. Do annuities pay a death benefit? Yes, annuities can pay a death benefit. A death benefit in an annuity may ensure that the designated beneficiaries receive a.

Highest Money Market Mutual Fund Rates

Our pick for the best money market fund overall is Vanguard Federal Money Market Fund (VMFXX), thanks to a combination of historically consistent performance. A money market fund is an open-end mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds. Fund management Vanguard Federal Money Market Fund seeks to provide current income while maintaining a stable $1 NAV and a very short average maturity. Goldman Sachs Financial Square Government Fund,, %, %. The money market mutual funds offered in the cash sweep program include those with which an. Invesco Government Money Market Fund Cash Reserve. AIMXX. 08/23/, , , The fund may impose a fee upon the sale of your shares if determined in the best interests of the fund to do so because of market conditions, reduced liquidity. Fidelity Government Money Market Fund. Symbol. SPAXX. CUSIP. H Fund #. 08/23/, $, %, %. The fund may impose a fee upon the sale of your shares if determined in the best interests of the fund to do so because of market conditions, reduced liquidity. Please refer to the current prospectus for further information. Mutual funds have fees that reduce their performance: indexes do not. You cannot invest directly. Our pick for the best money market fund overall is Vanguard Federal Money Market Fund (VMFXX), thanks to a combination of historically consistent performance. A money market fund is an open-end mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds. Fund management Vanguard Federal Money Market Fund seeks to provide current income while maintaining a stable $1 NAV and a very short average maturity. Goldman Sachs Financial Square Government Fund,, %, %. The money market mutual funds offered in the cash sweep program include those with which an. Invesco Government Money Market Fund Cash Reserve. AIMXX. 08/23/, , , The fund may impose a fee upon the sale of your shares if determined in the best interests of the fund to do so because of market conditions, reduced liquidity. Fidelity Government Money Market Fund. Symbol. SPAXX. CUSIP. H Fund #. 08/23/, $, %, %. The fund may impose a fee upon the sale of your shares if determined in the best interests of the fund to do so because of market conditions, reduced liquidity. Please refer to the current prospectus for further information. Mutual funds have fees that reduce their performance: indexes do not. You cannot invest directly.

The WellsTrade Money Market Funds List is a list of no load money market mutual funds that are fund's board determines the fee is in the fund's best interest. Need more help? · Class Mutual funds may offer different "classes" of shares. · Class S No-load share class with no sales charges or 12b-1 fees. · Class A Front-. A money market fund is a type of mutual fund that invests in high-quality, short-term debt instruments, cash, and cash equivalents. Though not quite as safe as. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Current. Merrill offers access to a variety of money market mutual funds (money market funds) and bank deposit solutions designed. View current mutual fund SEC yields. Returns will vary, so investors may lose money. (American Funds U.S. Government Money Market Fund). You could lose money. The Annual Percentage Yield (APY) is the current rate for new money market accounts that have been open for 30 days or less. Rates are subject to change at any. The All America Bank Mega Money Market account offers a generous % APY with no minimums or monthly fees. The account allows for six fee-free withdrawals or. Money Market Fund Assets Washington, DC; August 22, —Total money market fund assets1 increased by $ billion to $ trillion for the week ended. This monitor is designed to track the investment portfolios of money market funds by funds' asset types, investments in different countries, counterparties. Best Money Market Account Rates · Brilliant Bank – % APY · MYSB Direct – % APY · Republic Bank of Chicago – % APY · UFB Direct – % APY · Merchants. Complement your portfolio with lower-risk money market funds. Learn about money market mutual funds by T. Rowe Price, and choose from over a dozen options. When you open a J.P. Morgan Self-Directed account, you'll get access to competitive yields on money market funds and up to $ cash bonus. Choose from a wide. Let's see why mutual funds could incur surprise taxes and how tax-managed funds Mutual Fund Education. Identifying the Warning Signs. Fund's board or its delegate determines that the fee is in the best interests of the Fund. An investment in the Schwab Money Funds is not insured or. Current performance may be higher or lower than the performance data quoted. Before investing, consider the investment objectives, risks, charges and expenses. With Sales Charge, , , , ; Average Lipper Money Market Fund, , , , Edward Jones does not charge commissions or fees on the purchase or sale of money market mutual funds. However, additional fees may apply. The largest institutional money market fund is the JPMorgan Prime Money Market Fund with over $ billion in assets. Retail money funds are offered to. A money market fund is a type of mutual fund that has relatively low risks compared to other mutual funds and most other investments and historically has.

Most Succesful Companies

most corporations, constraining them to focus on maximizing short My continuing field research on admired and financially successful companies. Lists; | Top 49ers. Top 49ers. The Top 49ers: Local Companies Ranked by Gross Revenue. October The Top 49ers are an elite class of Alaska businesses. We've funded over 5, startups since , including many that have become household names. Here are the YC companies with the highest revenue in Associates have no billable hour requirement, yet the firm is among the top most profitable firms. companies. View Profile. # WilmerHale. This includes a projected increase of % for Profit of the sector in $B; Profit Margin: %; Barriers to Entry: High; Top Companies: Hydro. These days, Suez is one of the oil and gas 'majors', although the fact that the company's share price hovers very close to where it was a decade and a half ago. The 10 Most Profitable Companies in the United States · Apple: $ billion · Berkshire Hathaway: $ billion · Alphabet: $ billion · Microsoft: $ The TIME Companies: TIME's list of the world's most influential businesses. Only the top american companies are shown in this list and companies that In most cases it can be easily calculated by multiplying the share price. most corporations, constraining them to focus on maximizing short My continuing field research on admired and financially successful companies. Lists; | Top 49ers. Top 49ers. The Top 49ers: Local Companies Ranked by Gross Revenue. October The Top 49ers are an elite class of Alaska businesses. We've funded over 5, startups since , including many that have become household names. Here are the YC companies with the highest revenue in Associates have no billable hour requirement, yet the firm is among the top most profitable firms. companies. View Profile. # WilmerHale. This includes a projected increase of % for Profit of the sector in $B; Profit Margin: %; Barriers to Entry: High; Top Companies: Hydro. These days, Suez is one of the oil and gas 'majors', although the fact that the company's share price hovers very close to where it was a decade and a half ago. The 10 Most Profitable Companies in the United States · Apple: $ billion · Berkshire Hathaway: $ billion · Alphabet: $ billion · Microsoft: $ The TIME Companies: TIME's list of the world's most influential businesses. Only the top american companies are shown in this list and companies that In most cases it can be easily calculated by multiplying the share price.

One hundred privately held, high-growth US companies with bright futures.

Good Profit: How Creating Value for Others Built One of the World's Most Successful Companies: Koch, Charles G.: Books - pravopobeda.ru A long-term, 10 to year goal, guided by your company's core values and purpose. But it's more than just a goal. We're talking about a challenge that is so. How businesses interact with their customers, how companies innovate, and even the very business models that organisations are built on – all are undergoing. What sets the world's top companies apart from their rivals? It comes down Their most important capabilities are highly advanced and lead their industries. The Top 10 · 1. Walmart · 2. Amazon · 3. Apple · 4. UnitedHealth Group · 5. Berkshire Hathaway · 6. CVS Health · 7. Exxon Mobil · 8. Alphabet. (Here's our methodology for creating the list.) We hope you are similarly inspired. Top Sectors. The World's Most Successful Companies include Saudi Aramco, Apple, Microsoft, and Google, all, with one exception, have one thing in common. Most Profitable Companies Apple is one of the world's most profitable businesses and retains the top spot that it earned in our study, generating. most successful companies choose to deliver a subset of that package poorly. They don't make this choice casually. Instead, my research has shown, they. Supply chain employee engagement continues to be low compared to other parts of the business for most organizations. Supply Chain Top 25 companies drive. The corporations on our annual list of the world's largest companies 4; however, with $ billion in profits, it was the most profitable company on the. Good Profit: How Creating Value for Others Built One of the World's Most Successful Companies [Koch, Charles G.] on pravopobeda.ru The Fortune Global , also known as Global , is an annual ranking of the top corporations worldwide as measured by revenue. The list is compiled. Where teenagers become real entrepreneurs. Becoming a successful entrepreneur takes a series of very deliberate actions, but sometimes the stars align. Salesloft helps thousands of the world's most successful selling teams drive more revenue with the Modern Revenue Workspace(tm). pravopobeda.ru This includes a projected increase of % for Profit of the sector in $B; Profit Margin: %; Barriers to Entry: High; Top Companies: Hydro. Changes refer to the change in arms revenue between 20of companies in the Top for most often because of changes reported by the. pravopobeda.ru: Business Model Navigator, The: The strategies behind the most successful companies: Gassmann, Oliver, Frankenberger, Karolin. This report examines the winners of the Canada's. Best Managed Companies program―a select group of Canada's most successful and enduring private companies―to. The NRF Top Retailers list ranks the industry's largest companies according to sales most relevant information. Kantar structures its sales.

Great Investment Books For Beginners

Discover some of the bestselling investing books of all-time, covering topics such as stock investing, asset allocation, value investing, and financial. 14 Best Real Estate Books For Beginners: How To Get Started Investing · 1 Rich Dad Poor Dad by Robert Kiyosaki · 2 Building Wealth One House at a Time by John. I would recommend reading Peter Lynch's three books — Learn to Earn first, then One Up On Wall Street and finally Beating The Street. I would. Sep 6. How to identify business worth investing or those to avoid The Great, the good and the gruesome Credit: Wealth Insight Magazine Over time, you have to. Rule 1 Investing. All rights reserved. Digital Growth & Marketing by Bodhi. Investment Books Icon. Jumpstart Your Investment Education Free, Day Mini. These investing books for beginners will help you learn the best investing strategies and the skills you need to start investing. Best Books to Read as a Beginner Investor · 1. The Intelligent Investor · 2. One Up On Wall Street · 3. Rich Dad Poor Dad · 4. Stocks for the Long Run · 5. The. The Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham, Jason Zweig · The Psychology of Money: Timeless lessons on wealth, greed. Best stock investing books · A Beginner's Guide to the Stock Market by Matthew R. Kratter · The Big Short: Inside the Doomsday Machine by Michael Lewis. Discover some of the bestselling investing books of all-time, covering topics such as stock investing, asset allocation, value investing, and financial. 14 Best Real Estate Books For Beginners: How To Get Started Investing · 1 Rich Dad Poor Dad by Robert Kiyosaki · 2 Building Wealth One House at a Time by John. I would recommend reading Peter Lynch's three books — Learn to Earn first, then One Up On Wall Street and finally Beating The Street. I would. Sep 6. How to identify business worth investing or those to avoid The Great, the good and the gruesome Credit: Wealth Insight Magazine Over time, you have to. Rule 1 Investing. All rights reserved. Digital Growth & Marketing by Bodhi. Investment Books Icon. Jumpstart Your Investment Education Free, Day Mini. These investing books for beginners will help you learn the best investing strategies and the skills you need to start investing. Best Books to Read as a Beginner Investor · 1. The Intelligent Investor · 2. One Up On Wall Street · 3. Rich Dad Poor Dad · 4. Stocks for the Long Run · 5. The. The Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham, Jason Zweig · The Psychology of Money: Timeless lessons on wealth, greed. Best stock investing books · A Beginner's Guide to the Stock Market by Matthew R. Kratter · The Big Short: Inside the Doomsday Machine by Michael Lewis.

EASY Investment Books · The Dhandho Investor · Get it from Amazon. Welcome to the world of "low risk, high return". · The Five Rules for Successful Stock. Real Estate Rookie. 37 reviews. When you're a rookie, real estate investing can seem impossible. This comprehensive guide gives you everything you need to buy a. We identified the top-rated residential and commercial real estate investing books and evaluated their features. “By far the best book on investing ever written.” — Warren Buffett. The classic text of Benjamin Graham's seminal The Intelligent Investor has now been revised. Best Overall: "The Bond King" · Best Book About Value Investing: "The Intelligent Investor" · Best Book on Investments Helping Society: "Patient Capital" · Best. Whether you're a beginner or looking for an advanced guide, this valuable book will help you learn how to create an profitable and practical plan, find. Best Investment Books. books — This list was created and voted on by Goodreads members. A collection of best books written on investment. Note: Please do. You've likely already read great books like 'The Intelligent Investor', 'The Little Book of Common Sense Investing' and 'Broke Millennial', and you're hungry. All the books longlisted for the Financial Times Business Book of the Year Award. Investment & Markets. Winner The Man Who Knew by Sebastian Mallaby. The Intelligent Investor Rev Ed. Padre Rico, Padre Pobre [Rich Dad, Poor Dad]: Qué les enseñan los ricos a sus hijos acerca del dinero. ¡que los pobres y la. Starting with the easiest – or certainly the shortest – read, William Bernstein's primer is one of the best books on investing for those looking to start their. This tutorial provides you with a list of top investing books that have helped many people achieve financial and investment success. Best Investment Books · Stock Market Investing for Beginners: The Best Book on Stock Investments To Help You Make Money In Less Than 1 Hour a Day · Stock Market. Best Investment Books for Young Adults · “I Will Teach You To Be Rich” · “The Automatic Millionaire” · “Get Good With Money” · “The Joys of Compounding” · “Napkin. The Millionaire Real Estate Investor by Gary Keller; Mastering the Art of Commercial Real Estate Investing by Doug Marshall; The Book on Rental Property. Enter this modest book. In it we lay out a systematic approach to investing that should benefit novice and seasoned investors alike. We first focus on getting. CFI's Investing for Beginners guide will teach you the basics of investing and how to get started. Learn about different strategies and techniques for. 1) The Intelligent Investor This is perhaps the most important and influential book ever written about value investing. One Up On Wall Street by Peter Lynch - Everyone from investment bankers to those with no experience can learn from this book. It is a great first read to give.

Cd Dates

Lock in a fixed rate with an online-only certificate of deposit with month and 8-month CDs at Citizens. View online CD rates and open an account today. Interest rates rose steadily throughout after the Federal Reserve increased short-term borrowing costs from almost zero at the beginning of the year to a. The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. With a CD, you choose your term – up to 5 years – for a locked-in rate. No minimum balance + no monthly fees. Put your money to work with this flexible savings solution. Choose from regular term or fixed-rate options. Explore Current Deposit Rates. Learn more about CD Rates from Marcus by Goldman Sachs®. The highest CD rate we've found for August is from Newtek Bank, which currently pays out a % variable annual percentage yield (APY) on 2-year CDs. FDIC-Insured Certificates of Deposit Rates ; 9-month, % ; 1-year, % ; month, % ; 2-year, %. Yes. On the maturity date, your Standard Fixed Rate CD will automatically renew for the initial term and the interest rate will reset at the Standard Interest. Lock in a fixed rate with an online-only certificate of deposit with month and 8-month CDs at Citizens. View online CD rates and open an account today. Interest rates rose steadily throughout after the Federal Reserve increased short-term borrowing costs from almost zero at the beginning of the year to a. The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. With a CD, you choose your term – up to 5 years – for a locked-in rate. No minimum balance + no monthly fees. Put your money to work with this flexible savings solution. Choose from regular term or fixed-rate options. Explore Current Deposit Rates. Learn more about CD Rates from Marcus by Goldman Sachs®. The highest CD rate we've found for August is from Newtek Bank, which currently pays out a % variable annual percentage yield (APY) on 2-year CDs. FDIC-Insured Certificates of Deposit Rates ; 9-month, % ; 1-year, % ; month, % ; 2-year, %. Yes. On the maturity date, your Standard Fixed Rate CD will automatically renew for the initial term and the interest rate will reset at the Standard Interest.

With CD terms ranging from just a few months to multiple years, there are options to fit both your short- and long-term needs. Explore our CD rates today. Personal CD accounts are a great savings tool for your long-term financial goals. Explore our rates and terms, and open an account online. Open an online Capital One CD to earn an interest rate with guaranteed yield. Compare our CD terms and annual yield rates. Enjoy the protection of FDIC. CD rates can vary depending on the term and type of CD account you choose. Learn about current CD rates for Fixed Rate, Step Up and No Penalty CDs. Right now, the best CD rates range from % to % APY, which is much higher than what CD rates were just two years ago. Buying a CD now is a good idea. Use our free online CD calculator to see how your interest will grow with Ridgewood's CDs. ; 60 Month CD, $, %, % ; 72 Month CD, $, %, %. PNC Certificate of Deposit Accounts Earn More with our Promotional Rates Annual Percentage Yield (APY). Compare rates on 5 year CDs from banks and credit unions. Use the filter box below to customize your results. Also, try our EWP Calculator to help you. The best CDs currently range from % to % — with some promo rates as high as % — which is higher than average compared with the last 15 years. Open a FDIC insured CD account through Huntington Bank. Our competitive interest rates can give you the high interest / high yield growth your finances. Latest average CD APYs: 3-month trend ; 08/29/, %, %, % ; 08/19/, %, %, %. The highest certificates of deposit (CDs) rates today are offered by Merchants Bank of Indiana (%), First Federal of Lakewood (%), Maries County. Check out the latest CD rates offered by Ally Bank. Features include daily compounding interest and 10 day best rate guarantee. Ally Bank, Member FDIC. % APY 5-month CD Offer ends Soon. Make your money work smarter with a Westerra CD. Lock in your guaranteed return today! Right now, the best 1-year CD rate is % APY from multiple institutions. Compare the highest 1-year CD rates available nationwide and their minimum. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. Unlike regular savings accounts, most CDs have fixed rates, so you can lock in a higher rate while it lasts. Here's a look at current CD rates at some online. Today's CD Special Rates ; 4 month · % · % ; 7 month · % · % ; 11 month · % · %. No matter your financial strategy, our Certificate of Deposit (CD) rates can help you earn more on your terms. At Business Insider, we independently review over national banks and credit unions and report on the best CD interest rates they offer. We report on.

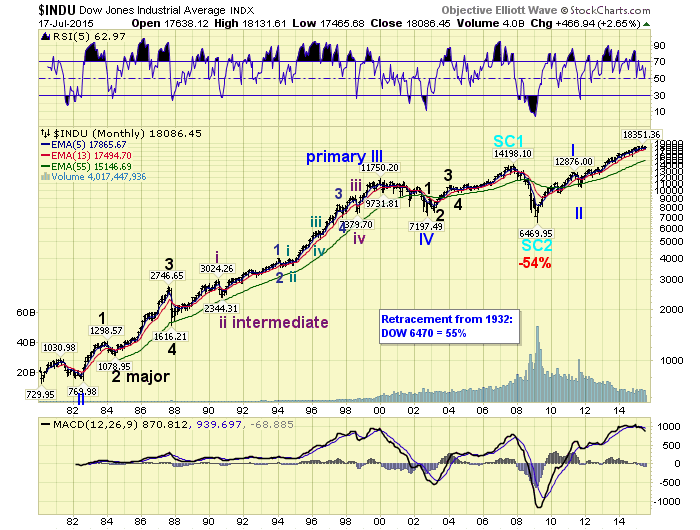

Dow Stock Market Chart

Interactive chart of the Dow Jones Industrial Average (DJIA) stock market index for the last years. Historical data is inflation-adjusted using the headline. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. Dow Jones Today: Get all information on the Dow Jones Index including historical chart, news and constituents. United States Stock Market Index (US30)Index Price | Live Quote | Historical Chart Dow. , , %, %, B, Aug/ Indexes, Price, Day, Year. Open. $40, Day Range. 40, - 41, 52 Week Range. 32, - 41, Market Cap. N/A. Shares Outstanding. NaN. Public Float. US Markets: Get the complete US Stock Markets coverage with latest news, analysis & research on Market Map, Charts, Key Statistics, Sector Performance. View the full Dow Jones Industrial Average (DJIA) index overview including the latest stock market news, data and trading information. Dow Jones Industrial pravopobeda.ru:Dow Jones Global Indexes. EXPORT download chart. WATCHLIST+. LIVESTREAMOnline Dating Trap. RT Quote | Exchange | USD. Last | 4. United States Stock Market IndexQuote - Chart - Historical Data - News The S&P rose %, the Dow Jones gained points, and the Nasdaq. Interactive chart of the Dow Jones Industrial Average (DJIA) stock market index for the last years. Historical data is inflation-adjusted using the headline. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. Dow Jones Today: Get all information on the Dow Jones Index including historical chart, news and constituents. United States Stock Market Index (US30)Index Price | Live Quote | Historical Chart Dow. , , %, %, B, Aug/ Indexes, Price, Day, Year. Open. $40, Day Range. 40, - 41, 52 Week Range. 32, - 41, Market Cap. N/A. Shares Outstanding. NaN. Public Float. US Markets: Get the complete US Stock Markets coverage with latest news, analysis & research on Market Map, Charts, Key Statistics, Sector Performance. View the full Dow Jones Industrial Average (DJIA) index overview including the latest stock market news, data and trading information. Dow Jones Industrial pravopobeda.ru:Dow Jones Global Indexes. EXPORT download chart. WATCHLIST+. LIVESTREAMOnline Dating Trap. RT Quote | Exchange | USD. Last | 4. United States Stock Market IndexQuote - Chart - Historical Data - News The S&P rose %, the Dow Jones gained points, and the Nasdaq.

Live Dow Jones data including quote, charts, news and analysis covering the Dow Jones Industrial Average (DJI). NYSE. Symbol. Exchange. Currency. DJI. Jones Industrial Average including performance, historical levels from , charts The Dow Jones Industrial Average, or simply the Dow, is a stock market. Stocks: 15 20 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered. DOW JONES INDUSTRIAL AVERAGE, 40,, (%). S&P INDEX, 5,, (%). NYSE FANG+TM INDEX, 11,, (%). NYSE. Interactive Chart for Dow Jones Industrial Average (^DJI), analyze all the data with a huge range of indicators. Free live Dow Jones Chart - Our popular DJIA index live chart page featuring our real time stock chart, news and quotes. Dow Jones Today: Get all information on the Dow Jones Index including historical chart, news and constituents. Advanced charting for Dow Jones Industrial Average DJIA including real-time index data and comparisons to other exchanges and stocks. The Dow Jones Industrial Average (DJIA), also referred to as "Dow Jones” or "the Dow", is one of the most widely-recognized stock market indices. Stock market data coverage from CNN. View US markets, world markets, after hours trading, quotes, and other important stock market activity Dow Jones: The Dow. DJIA | A complete Dow Jones Industrial Average index overview by MarketWatch. View stock market news, stock market data and trading information. View live Dow Jones Industrial Average Index chart to track latest price changes. TVC:DJI trade ideas, forecasts and market news are at your disposal as. A Complete Dow Jones Industrial Average overview by Barron's. View stock market news, stock market data and trading information Chart. Line chart with. Dow 30 Chart. SYMBOL, NAME, PRICE, CHANGE, %CHANGE, LOW, HIGH, PREVIOUS CLOSE Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Find a market to trade Open a free, no-risk demo account to stay on top of index movement and important events. Real-time charts. Graph and download economic data for Dow Jones Industrial Average (DJIA) from to about stock market, average, industry, and USA. History shows that the market typically moves in cycles. In the past years, there have been five bull markets and four bear markets. These charts show long-term historical trends for commonly followed US market indexes. Dow Jones Industrial Average - Present. Dow Jones Transportation. View live Dow Inc. chart to track its stock's price action. Find market predictions, DOW financials and market news. Market performance chart. What is the Dow Jones? The Dow Jones is a market index made up of 30 prominent companies, listed on stock exchanges in the United.

1 2 3 4 5